- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Can Archer Aviation Become the Tesla of the Skies?

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Tesla (TSLA) does not just make cars. It has reshaped our understanding of what cars can be.

Archer Aviation (ACHR), valued at $5.5 billion, is developing electric vertical take-off and landing (eVTOL) aircraft, which are essentially air taxis intended for short-distance urban and regional travel. Archer Aviation stock has gained just 2.3% in the year to date, underperforming the S&P 500 Index ($SPX), despite its massive 167% gain over the past 52 weeks.

For this under-the-radar aerospace company to become “the Tesla of the skies,” it must do more than just make air taxis viable. It must also make them desirable and indispensable for daily travel.

Let us find out how Archer Aviation is working on this, and if the stock is a buy now.

An Industry Moving From Ambition to Execution

The eVTOL industry was once considered futuristic. But it is rapidly becoming a reality. Archer’s flagship product is the Midnight aircraft. The company currently has six additional Midnight units in production, with three in final assembly, bringing the fleet to eight aircraft. These models have a production-ready four-bladed rear propeller design and are ready for certification flight testing or early commercial deployment.

Archer is rapidly approaching the commercialization of its Midnight aircraft, signaling a critical period of progress in both civil and defense programs. In the second half of 2025, Archer intends to accelerate pilot and flight testing, expand performance parameters, and begin full eVTOL operations. Because the company has no revenue yet, it reported an adjusted EBITDA loss of $119 million and an adjusted net loss of $114 million in the second quarter.

Perhaps the most notable achievement for Archer is the U.S. government’s decision to showcase air taxis at the Los Angeles 2028 Olympics. It is the official exclusive air taxi provider for the event.

Archer is not waiting for FAA approval to start monetizing Midnight. Through its Launch Edition Program, the company is delivering early aircraft to countries with more favorable regulatory environments, including the United Arab Emirates, Ethiopia, and Indonesia. These partnerships not only diversify Archer’s revenue streams, but also help to establish the business case for eVTOLs. In the UAE, the Midnight aircraft has already been delivered and is awaiting commercial flight authorization. This will help the company generate revenue. Analysts expect Archer to report revenue of $1.42 million in 2025, rising to $103.4 million by 2026.

The Challenges

Archer ended the second quarter with $1.7 billion in cash and cash equivalents, following a capital raise of $850 million in June. Despite strategic investments in manufacturing, certification, and defense programs, Archer maintained disciplined capital allocation. Furthermore, a growing multibillion-dollar order book from both government and commercial customers helps to strengthen the company’s position. Early launch deals abroad offer significant revenue potential before the full U.S. rollout.

Without a doubt, Archer is following Tesla’s leadto dominance by controlling manufacturing, developing proprietary technology, and pursuing both consumer and government markets. However, the challenges to eVTOL adoption differ. Infrastructure development, public trust, air traffic integration, and safety certification are challenges that Tesla has never encountered in the automotive industry.

If Archer can overcome these challenges, it will have established an industry with potentially fewer direct competitors than the crowded EV car market that Tesla is currently facing.

What Is Wall Street Saying About Archer Aviation Stock?

Recently, Canaccord Genuity analyst Austin Moeller reiterated his “Buy” rating on Archer Aviation stock with a price target of $13, citing the company’s strong production momentum and solid financial position. Moeller believes that by focusing on refining manufacturing processes and increasing efficiency, Archer is well-positioned to expand operations. Early revenue opportunities from Launch Edition customer evaluations strengthen Moeller’s belief in the company’s growth prospects.

Separately, H.C. Wainwright analyst Amit Dayal reiterated his “Buy” rating on the stock. Dayal stated that, in addition to its urban air mobility plans, Archer is expanding into the defense market through recent acquisitions and the development of a hybrid electric aircraft for long-range and military applications. With catalysts ahead, such as certification completion and the first passenger flights, Dayal believes the company is well-positioned to create meaningful value in the years to come.

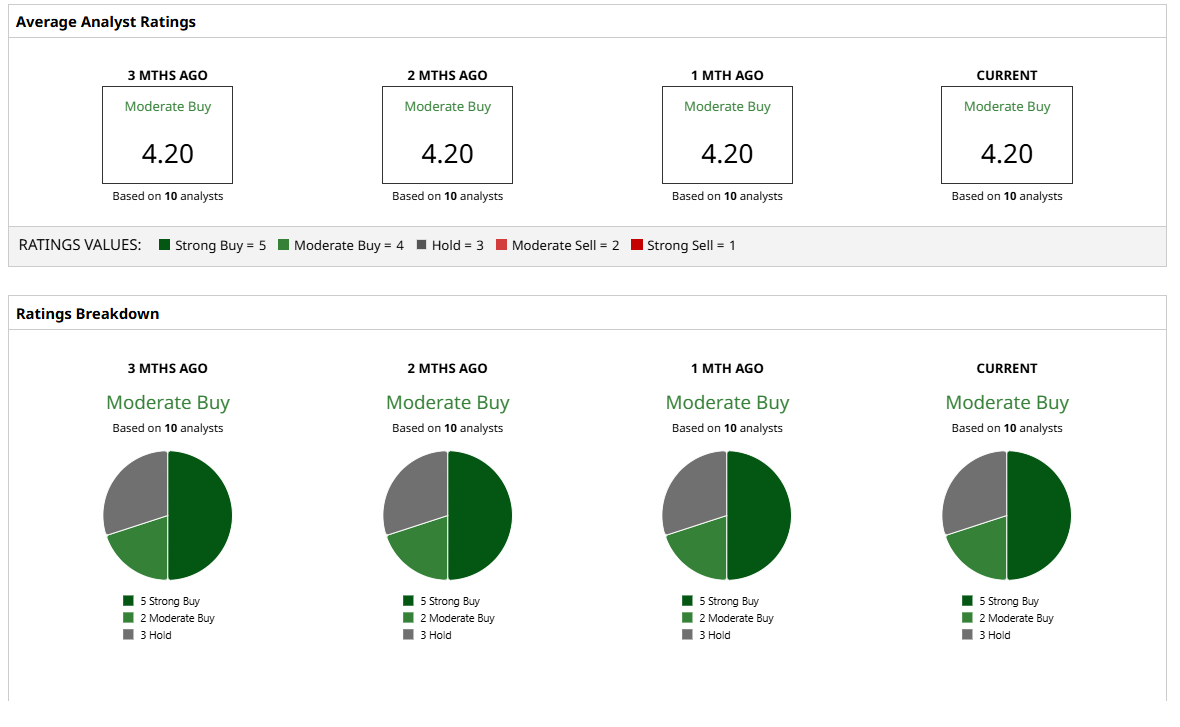

Overall, Archer Aviation stock is a “Moderate Buy” on Wall Street. Among the 10 analysts covering the stock, five rate it a “Strong Buy,” two say it is a “Moderate Buy,” and three rate it a “Hold.” The average target price of $12.39 is 25% above current levels. Plus, its Street-high estimate of $18 suggests the stock can rally around 82% over the next 12 months.

The Bottom Line

If Archer follows through on its promises, such as launching Olympic-scale air taxi operations, expanding its Launch Edition footprint, and entering defense markets, it has the potential to define the first generation of practical, profitable urban air mobility. If the company succeeds, flying cars will no longer be considered science fiction. Archer Aviation would have made this happen. Early investors who believe in the company’s potential and are willing to take on the short-term risk may profit handsomely once it reaches its full potential.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.